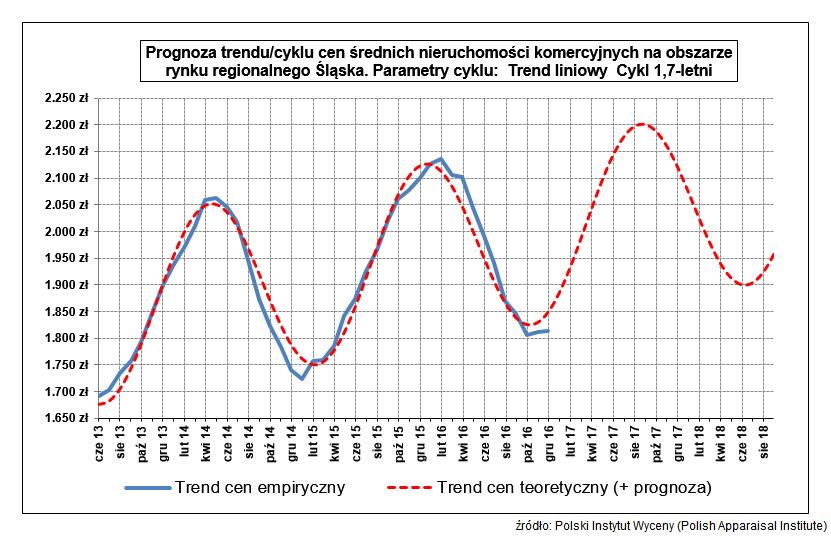

We recommend the latest results of research and analyzes of the Polish Valuation Institute relating to the forecast of commercial real estate prices in the area of the regional market of Silesia in 2017 and the next period, published on February 27, 2017 by the President of the Institute, Tomasz Kotrasiński .

If only the observed regularities from the last two cycles of changes in commercial real estate prices in the area of the Silesian regional market repeat (which, of course, is by no means certain), a forecast can be made as to the nature of 2017 in terms of the increase / decrease in the price level.

For this purpose, the course of the theoretical price change was estimated in a known period, i.e. from mid-2013 to the end of 2016, using the least squares method.

The simplest possible trend flow model was adopted: linear trend + 1 cycle. The parameters obtained by the least squares method: trend PLN 0.122 / m2 / day (approx. 2.4% / year) + cycle with a period of 612 days (approx. 1.7 years) and an amplitude of PLN 169 / m2.

The obtained course of such a cyclic function was extended into the future for prognostic purposes. He showed: the peak of the cycle around October 2017 and the next bottom of the cycle around May 2018.

This is, of course, a very simple, approximate forecast based on only one price parameter and one simple cycle. As we know, the market is influenced by many cyclical, non-cyclical and incidental factors. However, it is known from practice that if a larger number of real estate market parameters (activity, prices and profitability) and macroeconomic parameters that are clearly cyclical are taken into account, quite accurate and useful forecasts can be formulated.

::

Tomasz Kotrasiński , MPAI